Credit vs. Debit: Which One Should You Use?

When making a purchase, you often have the option to pay with either a credit card or a debit card. While they may seem similar, these two payment methods function quite differently and can impact your finances in various ways. Understanding the key differences between credit and debit can help you make smarter financial decisions.

What Is a Debit Card?

A debit card is linked directly to your bank account and allows you to spend only the money you have available. When you swipe or insert your debit card, the funds are immediately deducted from your checking account. Debit cards work like digital cash and can be useful for those who want to manage their spending and avoid debt.

Pros of Using a Payment Card:

- No Debt: Since you’re only using money from your account, there’s no risk of accumulating credit card debt.

- No Interest Charges: Unlike credit cards, debit cards don’t charge interest on purchases.

- Easier Budgeting: Because your spending is limited to what’s in your bank account, you’re less likely to overspend.

- No Credit Check Required: Debit cards are accessible to nearly everyone, including those with bad or no credit history.

Cons of Using a Debit Card:

- Limited Fraud Protection: If your debit card is lost or stolen, you may have fewer protections compared to credit cards.

- No Credit Building: Using a debit card won’t help improve your credit score.

- Fewer Perks and Rewards: Unlike many credit cards, debit cards usually don’t offer cashback, travel points, or other rewards.

What Is a Credit Card?

A credit card allows you to borrow money up to a certain limit, which you must pay back later. If you don’t pay the full balance by the due date, you’ll be charged interest on the remaining amount. Credit cards are a powerful financial tool when used responsibly.

Pros of Using a Credit Card:

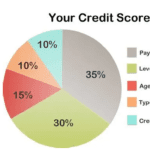

- Builds Credit Score: Responsible use of a credit card helps establish and improve your credit history.

- Fraud Protection: Most credit cards offer strong fraud protection, and unauthorized charges can often be disputed easily.

- Rewards and Perks: Many credit cards offer cashback, travel rewards, and other incentives for spending.

- Emergency Fund Access: Credit cards can serve as a financial safety net if you need to make an urgent purchase and don’t have enough cash on hand.

Cons of Using a Credit Card:

- Risk of Debt: If you overspend and don’t pay off your balance, interest charges can add up quickly.

- Interest and Fees: Late payments can lead to hefty interest charges and potential fees.

- Requires Discipline: Without careful budgeting, it’s easy to accumulate debt and hurt your credit score.

When Should You Use a Payment Card?

- Everyday purchases to keep your budget in check

- When you want to avoid interest charges

- If you have a habit of overspending and want to control it

- When withdrawing cash from an ATM to avoid cash advance fees from credit cards

When Should You Use a Credit Card?

- Large purchases where fraud protection is important

- Online shopping for additional security

- When you want to build or improve your credit score

- If you can pay off the balance in full each month to avoid interest charges

- To take advantage of cashback, travel perks, or other rewards